Perhaps no singular economy in the world has grown and expanded as rapidly as China’s. “Made in China” labels prove just how far of a reach China has globally – from clothes to technology to automotive parts. But there’s another facet of this expansion that is poised to become more and more important.

Developing countries across the world face infrastructure challenges that hinder their growth and prosperity, and these challenges have only been exacerbated by COVID-19. China, along with other key economic players, is sensing this sore lack, and competing to invest in global infrastructure projects. There are many questions to be asked about the ethics and impact of global infrastructure investment, but one thought in particular rises to the top: what does infrastructure investment mean for the climate?

To prod at this question, the Duke University Center for International and Global Studies hosted a conversation with Dr. Jackson Ewing on September 29 entitled “The Great Infrastructure Game: Why Asia, Europe, and America are Competing to Build in the Developing World and What It Means for the Global Climate”. Ewing, who holds a joint appointment as a senior fellow at Duke University’s Nicholas Institute of Environmental Policy as well as adjunct associate professor at the Sanford School of Public Policy, unpacked the “game” by taking a specific deep dive into China’s investment sources, standards, and approaches.

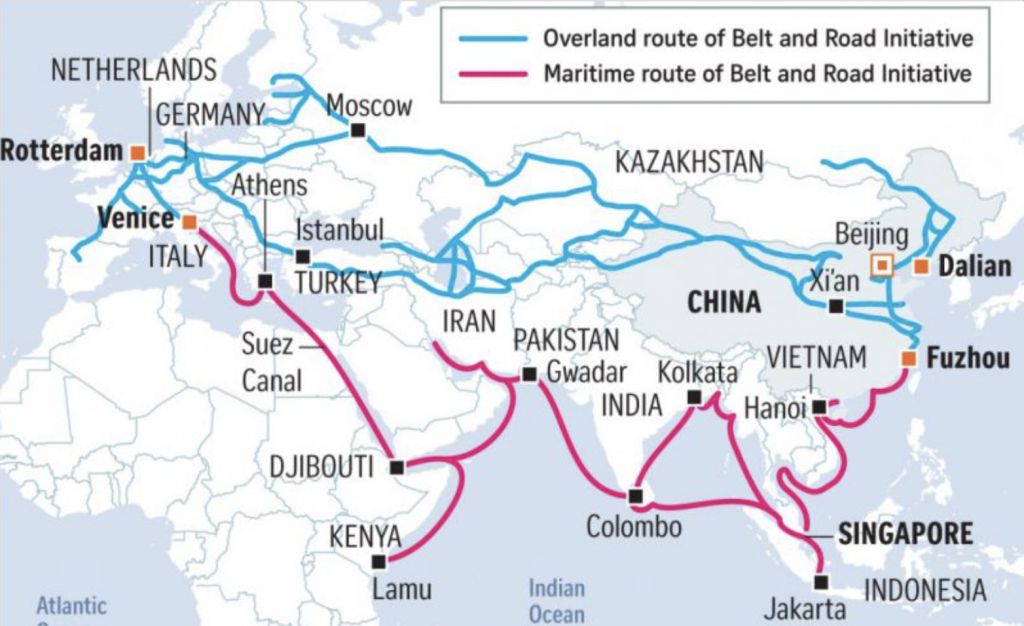

A couple of key things stood out from the conversation. The first is that to understand China’s infrastructure investment impact, it’s important to understand the Belt and Road Initiative (BRI). The BRI is arguably the most important “umbrella mechanism” for China’s infrastructure investment, associated with projects such as ports, railways, airports, and power plants. Launched in 2013, its name comes from the concept of the Silk Road, an ancient network of trade routes connecting China to the Mediterranean, that was established during the Han Dynasty 2,000 years ago. This modern-day Silk Road connects Asia with Africa and Europe via land and maritime networks. The initiative defines its five major priorities to be “policy coordination, infrastructure connectivity, unimpeded trade, financial integration, and connecting people.”

The BRI has led to what Ewing called “meteoric investment growth.” What does that investment look like? Ewing made note of several key characteristics. One is that Chinese lending has shifted significantly, from lending to sovereign banks to lending to companies and organizations in destination countries. This type of investment makes up nearly 70% of China’s portfolio. Another characteristic of this investment is that a chunk of the BRI project portfolio – 35%, to be exact – has encountered massive criticism on the grounds of corruption and environmental issues.

Previously, energy investment along the BRI looked mostly like coal. Between 2007 and 2015, China led all nations in financing nearly 25 billion dollars of outbound coal creation, with India, Indonesia, Mongolia, Turkey, and Vietnam being its biggest recipients.

Ewing noted that while China arguably does have a coal overcapacity problem, “it still compares significantly in outbound renewables.” The diagram below gives a breakdown of BRI energy investments – while the orange chunk of coal is still the biggest chunk of investment, the green renewable chunks don’t lag far behind. This increased interest in the renewable space is largely fueled by capacity problems, as well as domestic and environmental challenges. There has been a plateauing of coal consumption in the country – but is that something to get excited about?

There have been cross-ministerial efforts to promote a Green BRI in response to criticism, but as Ewing put it, “They’ve led to debatably meaningful practices to undergird existing initiatives.” While coal investment has slowed down as hydro investment has picked up the pace, China’s annual energy finance from policy banks has taken a hit and is slowing down. So what can we conclude?

Well, it’s safe to conclude two things. The first is that this Chinese shift away from coal does matter – but whether this will lead to a change in Chinese investment philosophy that will mark the next decade remains to be seen. The second thing to conclude is that as China dips more into the renewable space, other countries will follow. In fact, the U.S and EU have been prioritizing renewable investments for a while. This competition may very well mean that we see a growing number of renewable projects, which is undoubtedly good news for the climate.

Post by Meghna Datta, Class of 2023