“White Americans have been provided with up escalators they can ride to reach their goals without hurdles. Meanwhile, Black Americans have been forced onto down escalators which they must run-up to reach their destination.”

The Samuel Dubois Cook Center on Social Equity at Duke University recently released a striking report on Black wealth in America, entitled “Still Running Up the Down Escalator: How Narratives Shape our Understanding of Racial Wealth Inequality,” This 36-page report, written by Natasha Hicks, Fenaba Addo, Anne Prince, and William Darity examines the stark inequalities in the economic situation of Black Americans.

“Despite a decade of philanthropic investment and renewed attention from progressive elected officials, policymakers, and advocates, we have yet to make discernible progress in ensuring Black families have the power and freedom wealth bestows,” the report says (page 1).

“The typical Black household’s wealth (in 2019) was $24,100; for White households, it was $188,200. This translates into the typical Black household holding about 12 cents for every dollar of wealth held by the typical White family– a disparity that has remained largely unchanged since 1989 (Kent and Ricketts, 2020).” ( page 6)

Black families are disproportionately shut out of access to opportunities that would improve generational wealth, such as home loans, business loans/ownership, and financial assets. Because of the long history of these inequalities, Black wealth in America has improved little in the last 10 years.

The report continues by analyzing how Covid-19, the worst Pandemic in US History, has widened the wealth gap in America.

“Racial wealth inequality remains a persistent defining American issue, particularly in the wake of the COVID-19 pandemic’s disproportionate toll on the physical and financial health of Black people,” the report says. “The COVID-19 pandemic and the corresponding economic crisis have only exacerbated what was already a collective failing by policymakers and elected officials, who continue to invest in solutions focused on individual behavior instead of systems change.”

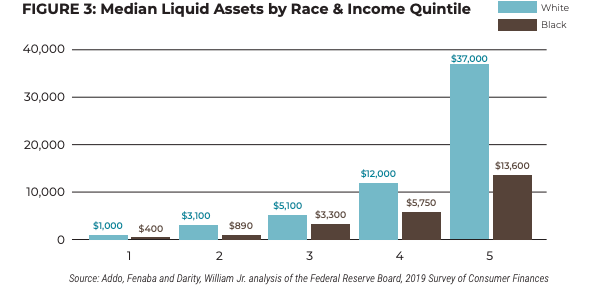

Covid-19 placed over 114 million people into unemployment over the course of the pandemic, with an overrepresentation of Black Americans in these figures. The figures below were published in the report to highlight the number of liquid assets and wealth available to white families versus black families in 2019, just one year before the pandemic.

As illustrated by these figures, the average White family in America maintains a leg up financially through both income and assets, which is why when the pandemic hit, black Americans were the ones disproportionately affected. Without access to high wealth modules or liquid assets to lean on, the economic wealth gap in America grew bigger.

The next part of the report talked about how false narratives in America regarding economic inequality is leading to unsuccessful aims of correction. In America, it’s a common theme to assume the problems faced by Black Americans are a cultural or personal issue, instead of a systemic one.

“Harmful narratives that characterize Black Americans as unintelligent, lazy, and criminal reinforce the notion that racial wealth disparities between Black and White households arise from differences in culture, values, skills, and behavior.” (page 10) Themes of anti-Blackness and personal responsibility, or a bootstrap mentality, were key systemic factors noted in the report. These factors impacted almost every aspect of Black America, including education, homeownership, entrepreneurship, family structure, and income and employment.

The report concludes by bringing up tangible solutions for these structural problems.

“The past year of crises is exposing the fact that we created systems, rules, and policies that actively and intentionally harm Black people. In order to truly address racial wealth inequality and the impact of the COVID-19 crisis, policymakers and funders must move away from solutions focused on behavioral changes and individual choices. Rather, they must take bold actions (backed by large scale financial investments) to shift dominant narratives and reimagine economic structures that support, uplift and protect Black people.” (page 23)

The authors make four broad proposals: shift harmful narratives, eliminate the racial wealth gap, dismantle extractive policies, and design programs to seed intergenerational wealth.

Economic disparities in America are a systemic issue, not a cultural or personal one. This report examines the interplay between this issue and the current pandemic, maintaining that the only way to create tangible change is through systemic solutions.

“America offers a false promise of equal opportunity and individual agency. For Black Americans, making all the right choices does not equal all the right outcomes. Just as wealth-building for White people in America was by design and government action, we need intentional and structural wealth-building strategies for Black Americans with investments compared to those given to White Americans. This requires a paradigm shift to truly tackle racial wealth inequality.” (page 36)

Written by Skylar Hughes, Class of 2025

Written by Skylar Hughes, Class of 2025